Rational Choice Theory

The rational choice theory states that individuals use rational calculations to make rational

choices, with the limited options they have available, to achieve outcomes that give them the

greatest benefit and satisfaction.

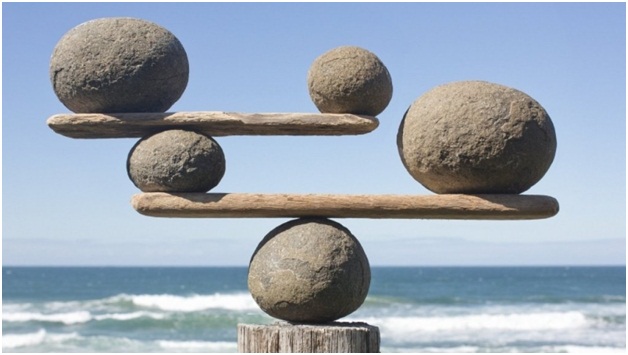

It means that people don’t randomly select products off the shelf. Rather, they use a logical

decision-making process that takes into account the costs and benefits of various options,

weighing the options against each other.

For example, one individual may decide that abstaining from drinking alcohol is best for them

because they want to protect their health, and another individual may decide they want to drink

because it relieves their stress. Although their choices are the exact opposite, both individuals

make these choices to get the best result for themselves.

Many mainstream economic assumptions and theories are based on rational choice theory. It is

associated with the concepts of rational actors, self-interest, and the invisible hand.

Founder:

Adam Smith, who proposed the idea of an "invisible hand" moving free-market economies in the

mid-1770s, is usually credited as the father of rational choice theory. Smith discusses the

invisible hand theory in his book “An Inquiry into the Nature and Causes of the Wealth of

Nations”, which was published in 1776.

The work of philosopher Thomas Hobbes’ “Leviathan” (1651) explains the political institution

function as a result of individual choices, and the work of Philosopher Niccolò Machiavelli “The

Prince” (1513) introduced ideas related to rational choice theory.

Self-Interest and the Invisible Hand:

The invisible hand is a metaphor for the unseen forces that influence a free-market economy.

First and foremost, the invisible hand theory assumes self-interest.

According to the invisible hand theory, individuals driven by self-interest and rationality will

make decisions that positively benefit the whole economy. Through the freedom of production,

as well as consumption, the best interests of society are fulfilled. The constant interplay of

individual pressures on market supply and demand causes the natural movement of prices and

the flow of trade.

Assumptions:

To fit the criteria for rational choice theory, the following assumptions are made:

1. All actions are rational and are made due to considering costs and rewards.

2. The rewards of a relationship or action must outweigh the cost for the action to be

completed.

3. When the value of the reward diminishes below the value of the costs incurred, the

person will stop the action or end the relationship.

4. Individuals will use the resources at their disposal to optimize their rewards.

Applications:

The rational choice theory has a wide variety of applications affecting human populations.

1. Economics and business: The rational choice theory can explain individual purchasing

behaviours.

2. Politics: It can be used to explain voting behaviours, the actions of politicians, and how

political issues are handled.

3. Sociology: It can explain social phenomena. This is because all social change occurs

because of individual actions.

4. Addiction treatment: It can be used to identify addiction motivations and provide

substance alternatives that are equally beneficial to patients.

When there’s a need to describe, predict and explain human behaviour, rational choice theory

can be applied.

Pros and cons:

The rational choice theory can help to understand individual and collective behaviors. It helps to

pinpoint why people, as a whole, move towards certain choices based on specific costs and

rewards.

It also helps to explain behaviour that seems irrational because rational choice theory states that

all behaviour is rational and any type of action can be examined for underlying rational

motivations.

A limitation of rational choice theory is that it focuses on individual actions. In reality, people

don’t always make rational decisions and are often moved by external factors, such as emotions.

Sometimes they don’t have perfect access to the information they would need to make the most

rational decision every time.

Another weakness is that it doesn’t account for intuitive reasoning or instinct. For decisions that

must be made in an instant, such as decisions that influence survival, there may not be time to

weigh the costs and benefits.

Criticism:

1. The rational choice theory doesn’t account for non-self-serving behaviour, such as

philanthropy or helping others, when there’s a cost but no reward to the individual. It also

doesn’t take into consideration how ethics and values might influence decisions.

2. It doesn’t comment on the influence of social norms. An argument against it is that most

people follow social norms even when they’re not benefitting from adhering to them.

3. It doesn’t account for choices that are made due to situational factors or are context-

dependent. Factors like emotional state, social context, environmental factors, and the

way choices are posed to the individual may result in decisions that don’t align with

rational choice theory assumptions.

4. It doesn’t account for individuals who make decisions based on fixed learning rules. This

means that they do things because that’s the way they’ve learned to do them even when

the decision has higher costs and fewer benefits.

In conclusion, a majority of classical economic theories are based on the assumptions of rational

choice theory: individuals make choices that result in the optimal level of benefit or utility for

them. Further, people would rather take actions that benefit them versus actions that are neutral

or harm them. Although many criticisms of rational choice theory exist—because people are

emotional and easily distracted, and therefore, their behaviour does not always follow the

predictions of economic models—it is still widely applied across different academic disciplines

and fields of study.

By

Abel Varghese George

II BSC